S corp payroll calculator

Use this calculator to get started and uncover the tax savings youll receive as an S Corporation. But as an S corporation you would only owe self-employment tax on the 60000 in.

S Corporation Tax Calculator Spreadsheet When How The S Corp Can Save Taxes Vs Sole Proprietor Youtube

1895 Total Savings From S-corp Conversion 1895 2 Review the Costs to Convert to S-Corp Initial state.

. C-Corp or LLC making 8832. Consider using payroll software to calculate s corp payroll taxes. Forming an S-corporation can help save taxes.

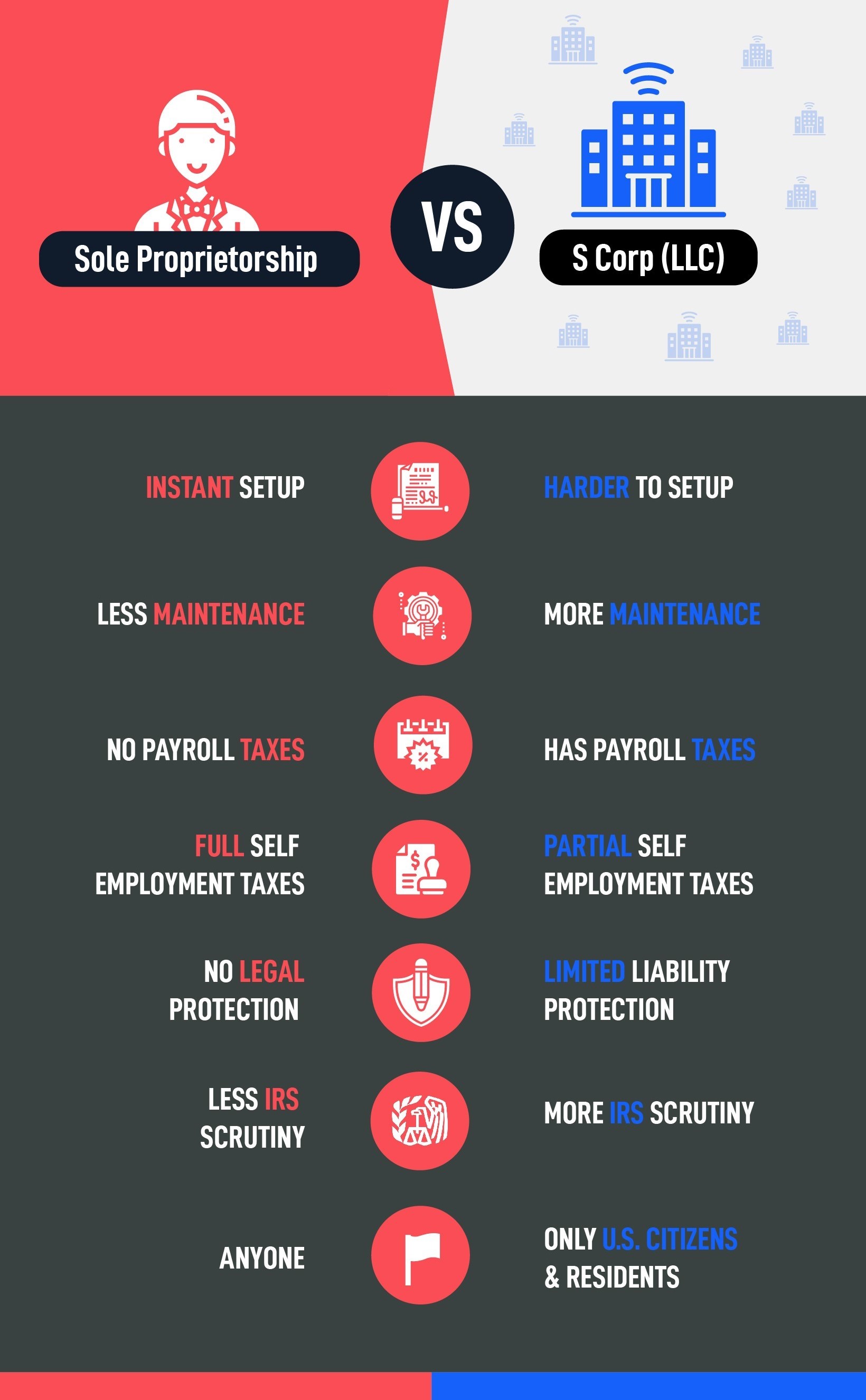

Check each option youd like to calculate for. Our S corp tax calculator will estimate whether electing an S corp will result in a tax win for your business. S Corporations reduce your taxes by lessening the amount of payroll or self-employment tax you pay.

Not every one-person corporation pays or even can pay an annual salary of 40000 to the shareholder-employee. As a sole proprietor you would pay self-employment tax on the full 90000 90000 x 153 13770. There are additional costs of having an S-Corp including payroll fees budget around 50 per month as well as tax filing fees depending on your CPA.

Partnership Sole Proprietorship LLC. This calculation is only valid if your. Herein lies the power of the S corporation.

Payroll services for S corporations QuickBooks gives S corps peace of mind with accurate payroll and tax penalty protection. Enter your estimated annual business net income and the reasonable salary you. S corp owners must also pay.

The S Corp Tax Calculator. 21020 Annual Self Employment tax as an S-Corp 19125 You Save. Those who are self-employed pay the entire 153.

Before using the S corp tax calculator you will need to. The calculator took one of these for you known as the self. Solo 401k Calculator For S Corp Pay yourself a reasonable wage on a W2.

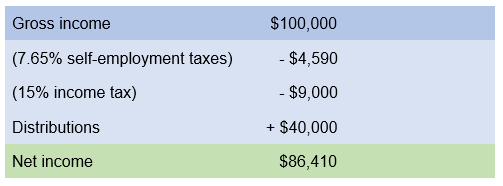

Another common rule dubbed the 5050. S-Corp or LLC making 2553 election. Lets say your S Corporation earns 100000 after expenses and you magically also have 100000 in the business checking account.

Calculate taxes and net payroll Like with payroll for standard employees S Corps must calculate and deduct the following from an employee owners wages. But a salary of 40000 it turns out is roughly the average. If you are an employee you pay 765 and your employer pays the other 765.

From the authors of Limited Liability Companies for Dummies. We are not the biggest. There are hourly and salary payroll calculators weekly and bi-weekly paycheck calculators or even calculators that ensure you give your 1099 or freelance employees the.

S corp owners are required to pay themselves a reasonable salary as employees and that salary is subject to payroll taxes more on this below. S-Corp owners are required to pay a reasonable wage that is subject to employment tax. A contract worker under a corp-to-corp.

Check out these payroll service features Payroll app Error. A commonly touted strategy to set your S Corp salary is to split revenue between your salary and distributions 60 as salary 40 as distributions. You transfer 50000 to your personal.

This calculator helps you estimate your potential savings.

Payroll Calculator Free Employee Payroll Template For Excel

S Corp Payroll Taxes Requirements How To Calculate More

Payroll Calculator With Pay Stubs For Excel

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

Llc Taxes Payroll Taxes Llc Taxes Payroll

The Basics Of S Corporation Stock Basis

S Corp Vs Llc Difference Between Llc And S Corp Truic

How Is Reasonable Compensation Calculated S Corporation Owner W 2s Youtube

Payroll Calculator With Pay Stubs For Excel

Cash Management Payroll 101 What Every Small Small Business Community Cash Management Community Business Payroll

S Corp Vs Llc Everything You Need To Know

S Corp Vs Sole Proprietorship Pros Cons Infographic

Payroll Calculator Free Employee Payroll Template For Excel

Payroll Calculator Free Employee Payroll Template For Excel

Sole Proprietorship Vs S Corp Tax Spreadsheet For Internet Publisher And Youtuber Which Will Save More Tax Money Techwalls

Payroll Calculator Template Free Payroll Template Payroll Templates

Payroll Calculator Templates 15 Free Docs Xlsx Pdf Payroll Template Payroll Templates